Thanks to Eagle Point Capital for letting me know Black Knight even existed with their write up. I highly recommend at least subscribing to their Substack. Also thanks to Dalius T on Seeking Alpha, he picked up on a few things that I never would have found.

Overview and Background

Black Knight offers the best work out play situation that I have been able to find. My main issue with arbitrage or work out plays is usually they requires buying into a shitco and hoping the deal goes through; however, what happens if the deal doesn’t go through? Well you get stuck with the shitco. Currently, Twitter is a good example of this. While I do think Musk will be required to buy Twitter, in that small chance that he gets a way out of it, you're stuck with Twitter shares, a fate worse than death. Luckily, Black Knight is far from a shitco, in fact it has a roughly 60% market share and is even undervalued at its current price regardless if the merger goes through or not.

Intercontinental Exchange Corporation (ICE), the operator of the NYSE, futures exchanges and commodity exchanges, offered to buy Black Knight (BKI) for ~$85 dollars per share in May of 2022. The deal will be funded with 80% cash ($68 per share) and 20% ICE shares. They expect the deal to close in H1 2023, which would result in north of a 30% annual return, so obviously I’m interested. My plan is to do a quick rundown of Black Knight, then the merger itself, and lastly ICE because Black Knight shareholders can opt to be put shares of ICE upon closing of the deal.

Black Knight

The predecessor to Black Knight, Computing and Statistics Service, was founded in 1962, but later became Computer Power Inc. in 1969. Then they were acquired by ALLTEL, so basically a name change, then Fidelity National Finance purchased ALLTEL in 2003, only to spin it off with Fidelity Information Systems in 2006. The company was then spun out into Lender Processing Services from FIS, then bought back by FNF in 2014 and renamed to Black Knight. Black Knight then went public in 2015 and has been acquiring and growing their business at a fairly decent rate eventually crossing over the 50% market share status. The sheer number of name changes is rather funny to me and I’m rushing through this section because there is a lot to cover.

Black Knight currently offers software-as-a-service to pretty much every major bank and institution that is involved in the 1st lien mortgage market (23/25 of the major institutions), while also selling their data to other clients, like real estate investors. Their Software Solutions segment comprises 85% of total revenue and is essential to the mortgage process with 63% first lien mortgage market share. Black Knight’s software allows consumers to apply for a mortgage, sign and upload documents online, prevent missteps in the process, and handle escrow among other things. Whether or not you knew it, if you have a mortgage you are more likely than not using some of Black Knights offerings. Black Knight also offers solutions to loan officers like, customer relation management, better loss mitigation techniques, foreclosure management. Black Knight pretty much offers a full set of offerings to both parties when it comes to servicing mortgages. To prevent excess exposure to mortgage originations, Black Knight has long term contracts with the institutions that increase annually in price based on the total number of mortgages serviced, which grows between 1 and 2% annually.

Their second segment is Data and Analytics which is 15% of revenue and is increasingly more valuable as the number of mortgages they process increases. The 10s of millions of mortgages that Black Knight has served has built an incredible set of data that they can sell to clients for risk management and just general decision making. In fact they actually cover 99.9% of the US population according to their 10k. Black Knight has been able to make automated valuation software and data aggregation for real estate agents. Overall this segment is not nearly as consistent as Software Solutions, but does have the cross selling optionality that should offset declines in revenue from potential negative market conditions.

Competitive advantages

Black Knight has one main competitive advantage that is incredibly powerful, switching costs. Black Knight’s software is so entrenched into the mortgage industry that it would take 18 months to switch off of their software. That's 18 months when no mortgages can be processed. Furthermore, other software ventures may not have software that is totally compliant with mortgage regulations, so switching to another venture incurs the risk that the company will have to switch back to Black Knight and lose 3 years worth of mortgages. Even if switching did not take so long, Black Knight’s software is currently the only one that has a complete offering and the cost to build an in-house system may simply be too high.

The high switching cost also provides Black Knight with the ability for price increases, which they have taken advantage of. While they do not disclose the price increase, Black Knight has grown revenue at around 6% annually, so assuming mortgage’s increase at 2% annually, that means they have been increasing the price at 4% annually. Because Black Knight is a scalable SaaS business, almost the additional increases in revenue drop to the bottom line. I would argue this is actually one of the strongest moats I have come across. A roughly 60% market share, which is growing, combined with the fact that none of their customers can leave makes this incredibly powerful.

Growth and Valuation

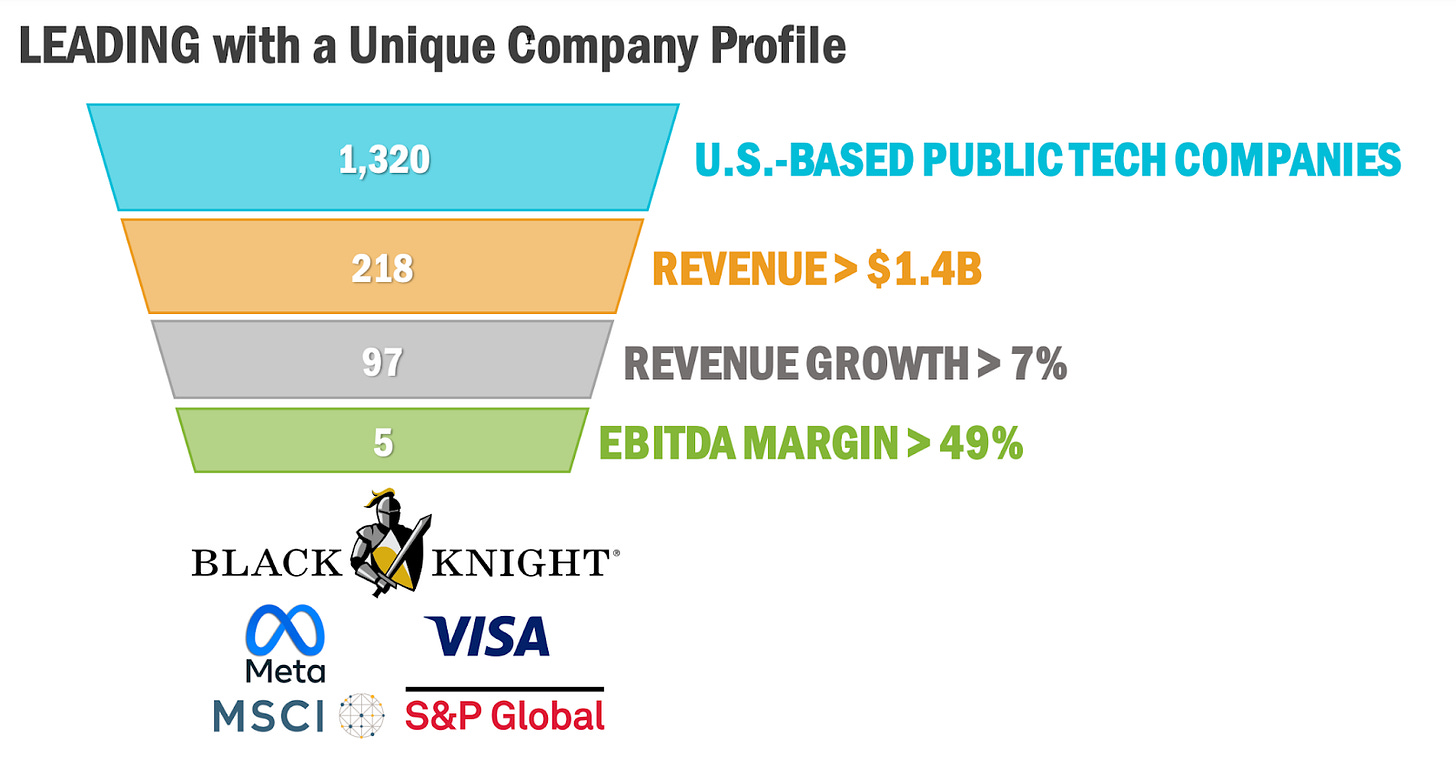

Growth has been and will be probably pretty consistent and be in the high single digits almost terminally. As mentioned previously, contract based revenue should increase at ~6% annually and combining that with market share gains and data and analytics should result in ~8% revenue growth with >49% EBITDA margins. Black Knight is actually in a very exclusive group of companies.

I’m not even sure Meta is part of this list anymore, so Black Knight is up there with Visa and S&P, two incredible companies. They have been doing numerous tuck-in acquisitions that have boosted revenue growth and should continue to do so, but betting on acquisitions isn’t my thing. Regardless, Black Knight’s 8% growth would require some form of rerating to generate some alpha, since there is no buyback program either.

Ultimately, BKI should be able to grow earnings across most, if not all economic cycles, which deserves some form of premium over the broader market. A 3% normalized fcf yield seems to be somewhat fair.

Black Knight also has a small investment in Dun & Bradstreet (DNB) worth ~$250 million or 18.5 million shares. DNB is a data analytics company for other corporations that also provides solutions for logistics and other random business related ventures. They have access to over 400 million business records and interestingly they spun off Moody’s in 2001. Data is quite sought after, but I really don’t know a fair valuation for DNB nor do I think it's necessary to find for the larger Black Knight thesis. It seems to be a bit of a turn around play after a long history of pretty crappy management with some pretty serious investors like Bill Foley. Even though it has been mismanaged there is a 96% revenue net retention rate on 85% recurring revenue, which suggests there is some moat there. I would suggest reading the DNB write up by cablebeach on VIC for some more information, but regardless it seems DNB is undervalued in some form.

Netting out the DND stake, Black Knight has an EV of ~$13 billion, which is roughly 30x normalized fcf. It would be easy to argue that Black Knight could grow at 6% in perpetuity, in which case a 9-10% forward return seems likely. Their tuck-in acquisitions could add a few percentage points to the forward return, but a 10% return in almost perpetuity is hard to scoff at. Not to mention the potential for the company to consistently buy back stock or for a slight rerating. Depending upon your assumptions, Black Knight could provide consistent low double digit returns in an almost “equity bond” like form and if that's what I get if the ICE deal doesn’t go through, I can’t complain at all.

The Merger

One interesting thing to note about the deal is that the deal price can move around ever so slightly. The 20% of the deal that is made up of ICE stock, is based on a 10 day average price, rather than a fixed one. ICE price movement will not affect the deal price much (as you can see from the table) and anyway I don’t think it matters as long as you can assign a value to the shares of ICE.

There is always a reason for a company to be trading at such a steep discount after a merger has been announced, and in this case, its antitrust regulation. These concerns are extremely valid, and to be fair, ICE post merger with Black Knight would essentially have a monopoly in the mortgage space. However, I still have reason to believe that the deal will ultimately go through, and if it doesn't, well that's fine too. Furthermore, the market is prescribing a 33% chance (my estimate) that this deal goes through, which I find to be rather low especially when compared to other current M&A deals.

As I’m sure you are all aware, President Joe Biden’s appointed chair of the FTC, Lina Khan, is strongly against large corporations like Meta, and has already broken up numerous deals like the Nvidia / ARM merger. She has mostly bipartisan support and started as a journalist which gives her a rather interesting lens into the business world. One lawyer I spoke to also mentioned that she is attempting to block mergers out of the idea that bigness is bad, even though being big is not illegal. Regardless, Ms. Khan can still sue and slow the process. Overall, the FTC is back in action and certain corporations will have to worry. Corporations are already worrying, in fact, Amazon and Facebook sent letters to the FTC requesting that Khan be disqualified from the appointment process (What does that say about Amazon and Facebook's position?) I think it's a good idea to look at past deals blocked by the FTC to get an understanding of what might go through, so I’ll take a quick look at Nvidia-ARM and Lockheed-Aerojet.

The Nvidia-ARM deal being blocked was really quite something, a $40 billion dollar merger being broken up, it showed that the FTC is actually willing to play ball. Interestingly, the FTC’s reason for doing so was “to protect our critical infrastructure markets from illegal vertical mergers that have far-reaching and damaging effects on future innovations.” There are other things at play, like China’s relation to ARM, but generally it seems the FTC blocked due to vertical integration which would lead to a decrease in future development and innovation, while also harming competition.

With the Lockheed-Aerojet deal, the FTC “sued to block Lockheed Martin Corporation’s $4.4 billion proposed vertical acquisition of Aerojet Rocketdyne Holdings Inc.” Once again to stop a vertical acquisition that could be used to harm competition and innovation. Like with ARM there are other factors at play, like harming national security with potential price hikes and so on.

While these were both vertical, the FTC has blocked many horizontal deals, including 4 hospital mergers this year alone, so it's a bit difficult to get a picture of what deals the FTC lets through and which ones they don’t. BKI-ICE does have a few things going for it, one being the sheer number of deals under review right now will cause quite the crunch at the FTC. Also, the deal size is relatively small and under the radar compared to Microsoft-Activision or Broadcom-VMware. Of course the management teams at Black Knight and ICE think the deal will go through saying:

“They hired a third party. We hired a third party... And both parties came back and then told us that they thought this was imminently doable, that there was very little of any overlap, that it was perfectly lawful and it was good for the consumer and good for the industry”Of course management is going to say that and that the deal is good for consumers. Their argument is that because of regulation, the price of mortgage origination has increased from 4k all the way up to ~9k with ¼ of that being from customer acquisition, so with pro-forma ICE controlling both origination (ICE) and serving (BKI) they won’t have to spend the ~2.25k in CAC per mortgage, thus lowering the cost for consumers and making mortgage more available as well.

ICE will probably follow through with this promise, but this also means less competition, so it will be an interesting debate. Competition is the main argument, but I still think ICE can duck it slightly. They actually provide API’s and operate open networks for their software, allowing developers to build off of it, and have non-exclusive deals with numerous start-ups. Furthermore, ICE mentioned that they would do the same with Black Knight’s offerings if the deal goes through.

While it will be very close, I think the merger will ultimately go through. In my mind, they will get a treatment similar to that of FICO, which would be letting them have the monopoly because it helps the consumer so much, but there will be someone watching them over their shoulder. Even if the deal doesn’t go through I really don’t care.

Another tech company and a then also a group of private equity firms offered to acquire Black Knight for $87.5 per share. There is definitely interest to acquire Black Knight, but it may come down to whoever can get it passed the FTC, if ICE can’t. If no merger goes through at all, that's still fine because as mentioned earlier, Black Knight is undervalued on a stand alone basis. Overall, BKI shareholders will be rewarded either through a deal or just by holding the business and the only decision that will have to be made is, if you want ICE shares or not.

Intercontinental Exchange (ICE)

Intercontinental Exchange is a huge company in the financial space that many people may never have heard of. They operate the NYSE, energy futures exchanges (also the Brent index), commodity exchanges, bond exchanges, and even offers tools to clear credit default swaps and originate mortgages. ICE has completed a ton of acquisitions to get to where they are today and the CEO, Jeffrey Sprecher, has shown to be a brilliant capital allocator being able to grow EPS at a 17% cagr over the last 15 years. The current revenue mix is as follows:

Surprisingly, the revenue mix is fairly diversified and with roughly 50% recurring revenue that is something special for a non-SaaS business.

Business Segments

As you can see from the charts above, ICE is divided into three segments: Exchanges, Fixed Income / Data Services and Mortgage Technology. The exchange segment, specifically energy exchange, is more the legacy segment of the company.

ICE was founded in 2000 as an energy exchange platform to increase transparency between power plants and gas companies, but the precursor company was founded in 1996 when Sprecher bought the Continental Power Exchange for $1 (plus debt). Thanks to the collapse of Enron there was a huge demand to be filled, so Sprecher got backings from the three major European oil companies and two major investment banks. Almost immediately after its founding, ICE began acquiring other exchanges like the International Petroleum exchange in 2001, and the Winnipeg Commodity exchange in 2007. ICE then started to expand outside of exchanges by acquiring Creditx, a credit default swap broker. After they acquired the NYSE in 2013, ICE went on to data & analytics with SuperDerivatives and Interactive Data Corporation in 2014 and 2015. ICE continued its spree of acquisitions into exchanges and data, until 2020 when they acquired Ellie Mae, thus expanding into mortgages.

The number of successful acquisitions is pretty impressive especially when considering this type of M&A typically performs the worst. I think it boils down to the fact that each acquisition fits into one of their defined playbooks. Management keeps referring back to either their fixed income or data playbook, which is something I really appreciate. It shows that management knows their circle of competence and will have some form of an edge over competitors who are trying to copy them. While this has changed slightly, here is a quote from Mr. Sprecher:

“In terms of M&A, I mean, we have kind of a play book here that you've witnessed for years. We like to buy very small immature companies that we think are poised for growth where when we bolt them on to the infrastructure that we have, we can accelerate their growth. That allows us to pay a premium for those companies knowing that just putting it into our network can accelerate that and deliver value for our shareholders even though we may have to pay a premium to buy the business. And then on the other extreme, we buy legacy businesses that have fallen out-of-favor that have sort of lost energy, and we go in and slice and dice them and sell off parts and reconstruct them, and try to re-energize them again, and that's worked very well for us. And so that, broadly speaking, we are sort of looking at the 2 endpoints of a company's life cycle, and we do well on both of those ends. It's less obvious to us that buying something in the middle, in other words, that's growing and fully priced, that we can make a difference.“Exchanges

Exchanges are heavily regulated by the SEC, with only 13 being approved in the US. I am sure we’re all familiar with them because after all if you're reading this, you probably have interacted with an exchange before. Exchanges are pretty much a two sided market palace for people who want to buy and sell equities, futures, or some other derivative. Exchanges charge a fee for each transaction that occurs on the platform, so for example, if you decide to buy some shares of Apple on the NYSE then ICE will charge maybe a penny or two for you to do that. A penny is nothing, but it adds up when millions of people are trading everyday, some using HFT. Energy and futures exchanges are able to charge higher fees as well. Furthermore, exchanges charge subscription fees to companies listed on their platform. As great as this might sound, unfortunately exchanges, specifically equity exchanges, are becoming a worse business than they once were because of some technology advancements. NYSE volumes have been falling as off-exchange volume has been rising.

This is a major problem for the equity exchanges and the main reason for ICE focusing on energy, commodities, and futures where the space is much more consolidated with little disruption.

Energy trading is a duopoly with CME and ICE and while many have tried to overthrow it, none have been successful because large banks have been indexing to already proven benchmarks like WTI or Brent. For those of you familiar with MSCI, ICE is also able to leverage their benchmarks to sell data & analytics, so it was only a natural expansion for them.

Data & Analytics and Fixed Income

I don’t really think there is too much to say about the data & analytics segment, it's pretty standard. They have a bunch of data flying off from their exchanges and numerous services, so it's only natural for them to sell that or sell some analytics tools. The segment is further broken down into fixed income data, exchange data, and desktops. (basically Bloomberg terminal, but fixed income focused) The fixed income sub-segment comprises roughly half of the segment and primarily makes its money from bond traders seeking access to fixed income pricing services and with the over 3 million fixed income securities in ICE’s data set, it's quite powerful. Exchange data is what you would expect, they sell data that is produced from the exchange to hedge funds or other institutions. Unfortunately for the desktop sub-segment, they are competing with a lot of powerful systems, especially Bloomberg, but seem to have found a niche with its credit focus

With fixed income, ICE is trying to do something fairly interesting, and that is to automate bond trading. The plan is to have a centralized order book with bids and offers where people can buy and sell bonds, like how they might do with stocks. They already “provide price transparency for nearly 3 million fixed income securities daily.” The main products that ICE offers for fixed income are efficiently related services and clearing services where they service over 90% of the global CDS market. Interestingly, as David Kim from Scuttleblurb pointed out, they approached valuation creation in a backwards manure for this segment. Traditionally, ICE would start with a product, like an exchange, then sell the data from it, but for fixed they started with data then went into product development. While this may not actually mean that much, it does further emphasize the strength of the management team.

Mortgage

ICE only recently got into the mortgage space with their acquisition of Ellie Mae in 2020. Ellie Mae is the largest provider of software for mortgage originations with 44% market share, with the only real competitors being in-house specific software from banks. Ellie Mae generates revenue both from recurring per-user subscription fees and per-mortgage transaction fees. Ellie Mae has grown market share at an insanely fast rate; their market share grew from 38% to 44% from 2018-2020, which has resulted in double digit revenue growth.

ICE also operates two other mortgage businesses, MERS and Simplifile. MERS is a database of mortgages with ~85% of newly originated loans registered on the database, and Simplifile, a mortgage closing network that offers electronic document submission and payment of recording fees. Unlike Black Knight, these businesses really rely on mortgage volumes, so naturally a down turn will impact these segments much more. In fact this is probably why the stock price has fallen. The general concern is that everyone took advantage of the ultra low interest rates over the past two years and will no longer need to apply for a mortgage. This is an extremely fair point, especially when looking at the total number of people moving homes each year, which is trending down.

Baileyb906 from Value Investors club does a nice job of explaining why this isn’t as big of an issue as most people believe.

“It’s important to keep this headwind in perspective… even if $500 million of transactional mortgage technology revenue goes up in smoke, this is only 7% of total 2021 ICE revenues. Even assuming an extremely high contribution margin on that lost revenue of 80% (which is probably a little draconian), this would create a 50-cent hit to earnings, or about 10% of TTM EPS. Assuming this worst case hit and assuming none of the other businesses grow – which is also a draconian assumption given the exchange and fixed income businesses grew 4% in the first quarter - EPS could drop to $4.73.In this worst-case scenario, with EPS of $4.73 versus consensus $5.42 for 2022, ICE shares are trading a P/E of 20x 2022 earnings versus 17x based on current consensus estimates.”As you can see, this is hardly an issue, which provides an interesting opportunity just to own shares of ICE outright. Returning to mortgages, with the acquisition of Black Knight ICE will now control all parts of the mortgage stack.

If the merger is actually able to go through, this will place them in a dominant market position with what I would consider monopoly status. Their origination and servicing market share will be about 60%. ICE has really placed themselves in a position to dominate the industry.

Future Returns

A lot of the past returns have been because of M&A, which is something I don’t like to bet on happening in the future; however, with ICE it's slightly different. I have never seen a company lay out their M&A approach so cleanly with it making so much sense.

It's just laid out so clearly and they even mention ROIC and moats. (I think Sprecher is secretly a Buffett fanboy) I’m still not able to really determine how these future deals may impact the forward returns, but for once, I think I will be surprised with the upside from them.

When not deleveraging from an acquisition, ICE has a yield of around 3%, but assuming the BKI deal goes through, the buyback program will be canceled and only the dividend will be providing a yield, dropping it to a little over 1%.

The current fcf yield is ~5%, so fcf yield + the dividend should result in a 6% return without any growth or rerating. Factoring in high single digit growth, ICE should return mid double digits without a rerating. At the current price of ~$100, I would expect returns to align with the historic 16% eps growth. It's by no means astounding, but the business is incredibly durable, so I personally don’t mind it.

Conclusion

In my view, this is the rare occurrence when investors are able to run an arbitrage play on two great companies, while they are both undervalued. It’s a great example of “heads I win, tails I don’t lose much.”

My apologies if I missed anything, made certain sections a bit too short, and for all my grammatical mistakes. I started to get a little tired of looking at BKI and ICE. As always, please let me know what I can improve upon.

Thanks for this write-up.