This is structured a little differently than some other posts. Someone had asked me to look into AI and its impact on drug discovery and who could stand to benefit. I most likely explained must of this poorly, so my apologies. I may update this post in the future as I learn more.

Background: Drug Development and the Pipeline

The traditional drug discovery process involves multiple stages that pharmaceutical and biotech companies must follow to bring new treatments to market. These stages are designed to ensure drugs are safe and effective while adhering to regulatory standards. The process begins with identifying biological targets—such as proteins or genes linked to a disease—and understanding their role in the disease or condition. Once the target is well-characterized, researchers identify compounds that can effectively interact with it. This often involves high-throughput screening, where thousands of chemical compounds are tested, followed by selecting and optimizing the most promising leads.

After potential drug candidates are identified, preclinical testing begins. This stage includes laboratory and animal studies to evaluate the drug’s safety, toxicity, and pharmacological properties. If the preclinical results are favorable, companies submit an Investigational New Drug (IND) application to regulatory agencies to begin clinical trials.

Clinical trials are conducted in three phases:

Phase I: Tests the drug on a small group of healthy volunteers or patients to assess safety and determine optimal dosage.

Phase II: Expands the study to several hundred participants, focusing on efficacy and identifying side effects.

Phase III: Involves thousands of participants to compare the drug’s effectiveness to existing treatments and gather more extensive safety data.

Upon successful completion of Phase III, the data is compiled into a New Drug Application (NDA) and submitted for regulatory review.

Despite its thoroughness, this process is lengthy and expensive, often taking 10 to 15 years and costing upwards of $1.3 billion per drug. However, a substantial number of drugs remain in development, with nearly 23,000 drugs currently in the pipeline.

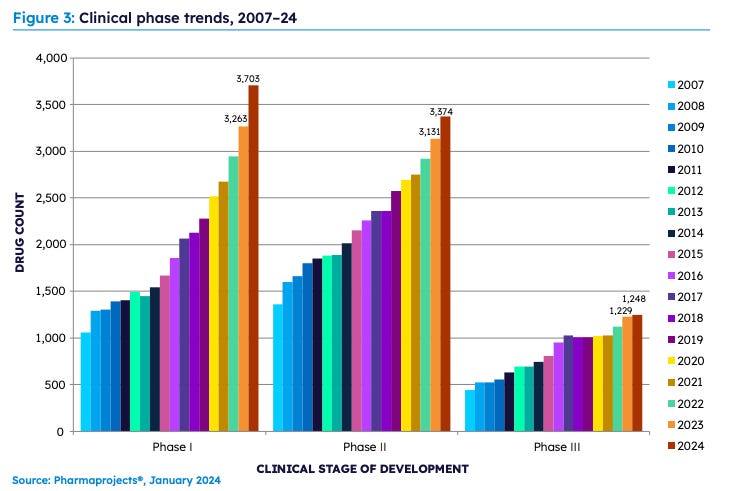

This graph only reflects the net yearly change in the pipeline. For example, in 2023, 5,428 drugs were added to the Pharmaprojects database, while 3,895 were removed, meaning almost 15 drugs enter the pipeline daily. That number is crazy to me. It's hard for me to even think of 15 drugs off the top of my head even after I get blasted with drug commercials in the middle of every sports game I watch on TV. However, the growth at the early stages of development far outpaces the progression toward later stages, as many drugs fail during later stages of testing.

As each drug gets tested more, more will inevitably fail, but also some companies simply don’t have enough money to conduct Phase III trials. These trials are extremely complex with sample sizes that are often multinational, so sometimes drugs just die out due to financial constraints. While somewhat sad that a promising drug can potentially just disappear, this is understandable as the mean cost to bring a new drug to market from 2009-2018 was $1.3 billion. Not many companies can burn through that much cash without going under. If only there were some new technology that could potentially increase efficiency while also reducing the cost of drug discovery…

AlphaFold and AI

AlphaFold is an AI system developed by DeepMind that, among other things, can predict a protein structure based on its amino acid sequence. To achieve this, the system uses a diffusion model, the same type of model used in image generation.

Diffusion models have two main steps: a forward process (used during pretraining) and a reverse process (used during generation). In the forward process, noise is added to the data incrementally, step by step, until the data becomes completely random, resembling an amorphous blob. Imagine starting with The Water Lily Pond by Monet and flicking paint at it repeatedly until the painting becomes just a canvas of noise.

The reverse process then begins. Continuing the metaphor, using what the model learned from studying many Monet paintings, the model predicts the noise added at each step and removes it incrementally to recover something that fits Monet's style. (Some sources suggest the model produces predictions for all the noise added, not just at each step.) The result isn’t an exact reconstruction of The Water Lily Pond, but rather a new painting that looks like it could belong in Monet's collection. By training on many examples, the model learns the patterns and characteristics of Monet’s work, enabling it to generate unique outputs that resemble his art while starting from pure noise.

In a specialized diffusion model, AlphaFold 3, the process starts with a molecular structure, turns the structure into a cloud of atoms, and removes atoms step by step to result in its output. Generating molecules is far more complex because of stereochemistry and the interactions between atoms or functional groups. Molecules are three-dimensional and require precise bond angles and distances between each atom. To account for this complexity, the model uses an atomic coordinate system during the “noising” and “denoising” phases. To prevent “hallucinations” (physically impossible molecules), AlphaFold 3 incorporates learned data from AlphaFold 2 as well as templates from extensive protein structure databases. The result is a model that is highly accurate, and given the speed at which it delivers results, its performance is extraordinary. AlphaFold 3 is 50% more accurate than traditional tools and the first AI model to outperform physics-based tools. Unfortunately, the accuracy does vary widely, with protein-RNA interactions considered to be notably inaccurate.

The new modeling capabilities of AlphaFold 3, most notably modeling ligands and chemical interactions of molecules, allow for greater drug discovery and even understanding of diseases. Using AlphaFold 2, researchers were able to “evaluate the pathogenicity of more than a thousand missense variants from ClinVar and a breast cancer patient cohort.” AlphaFold and other AI tools can allow researchers to further explore the interactions of disease with the human body, which may indirectly lead to further drug enhancements. While this all is still a new area of study, AlphaFold and earlier AI models have already found their way into clinical trials.

At the end of 2023, “24 AI-discovered molecules had completed Phase I trials” with a success rate of 87.5% compared to the historic success rate of 40-65%. For Phase II trials, ten molecules were completed with a 40% success rate compared to the historic rate of 30-40%. While I slept through most of my AP Stat class, I do remember that due to the incredibly small sample size, no conclusions can be drawn from this data yet. Nevertheless I want to say this is a good sign. Biotech and pharmaceutical companies seem to think so, at least, with AI. Dr. El Zarrad at the FDA said that from 2016 to May of 2024, the FDA had received approximately 300 applications for clinical trials that involve some use of AI.

With no experience in medicine and hardly any understanding of AI’s impact on medicine, it is difficult for me to come to any concrete conclusions about how to best take advantage of this. However, I don’t think it is too outlandish to say that if AlphaFold and similar AI models continue to be proven effective with drug discovery, then the number of drugs entering preclinical and clinical trials will increase. Furthermore, more small biotech companies with limited resources will be responsible for these drug discoveries. (This is already a trend with roughly 1,000 companies in the US developing just one drug.) This combination leads me to believe that contract resource organizations (CROs) could potentially stand to benefit more than expected from the use of AI in drug discovery.

CROs

A Contract Research Organization (CRO) provides support to pharmaceutical, biotechnology, and medical device companies by managing clinical trials and research processes. CROs handle tasks such as study design, patient recruitment, data collection, regulatory compliance, and statistical analysis. They ensure that trials are conducted efficiently, and in adherence to regulatory standards, enabling their sponsors to focus on product development and bringing treatments to market. CROs often enter contracts with their customers 3 years in advance of when they will begin the clinical trial, which provides a nice backlog and visibility into future earnings for the CROs. Along with a relatively higher degree of visibility compared to other industries, the CRO market is growing faster as well.

Alimentiv looked at nine studies and found that “the global contract research organization market is estimated to average USD $64.42 Billion for 2023 and is expected to reach over USD $102.57 Billion in 2028, with an average growth rate of 9.75% from 2023 to 2028.” The largest contributors to this outsized growth are general rises in R&D spending and an increased preference for outsourcing due to constraints like cost, or a lack of technical ability to complete clinical trials. Outsourcing clinical trials has grown substantially with 60% of clinical trials being outsourced in 2020.

To some degree CROs can be thought of as similar to consultants. A mom and pop retail company may not have the know-how to move the business to a new ERP system and find that hiring a consultant may be cheaper. Especially in healthcare with large regulatory and cost barriers, biotechs may not have the facilities to conduct adequate testing and trials and find that outsourcing to a CRO is the only option for them. However, even pharmaceutical companies that have the ability to conduct clinical trials themselves may find that outsourcing is still more beneficial for them because of CROs specialization.

Drug patents usually begin at the time of discovery. This is prior to clinical trials being conducted, so the longer the clinical trials take, the fewer number of years that patented drug is on the market. According to antidote.me, “delays can cost sponsors between $600,000 and $8 million for each day that a trial delays a product’s development and launch,” which is just crazy (I was unable to confirm their source for this though). Even more insane is that, despite this enormous cost caused by delays, 80% of trials are still delayed due to recruitment problems and according to Tufts, 41% of clinical trials fail to meet planned enrollment (another source suggests 85%). With the already high likelihood of delays and huge costs associated with them, it makes virtually no sense for a pharmaceutical company, let alone a small biotech, to attempt to conduct a clinical trial in-house. Companies seem to agree as CROs have been taking more and more market share in the clinical trial market.

The CRO industry has been under some temporary downward pressure as pharmaceutical and biotech companies have been spending less or getting less funding, but this is but another temporary downturn in the industry.

IQVIA

IQVIA formed in 2016 through a merger of two companies, IMS Health and Quintiles, forming the largest CRO with a current market share around 12%. IMS Health, now the Technology & Analytics Solutions segment, collects huge amounts of data on pharmaceuticals, patients, medical claims and basically everything medical related. The company now has >1.2 billion patent records, tracks >90% of pharma sales, and holds >64 petabytes of data. This data can then be sold back to pharmaceutical companies, medical device companies, or anyone who is looking for data to develop or improve upon a product. The raw data itself can only go so far, but what sets IQVIA apart is their ability to process the data and extract insights from it that competitors, like ICON, can’t do. Because of this, IQVIA is then able to charge a premium for its services, while also strengthening their moat.

Prior to the merger, IMS Health broke their business down into information and technology services segments, which is still how the TAS segment generates its revenue. Information is, well, selling information on a subscription or contract basis to clients for a variety of reasons like seeing how their drug is prescribed, what prescriptions trends across the industry are like, etc… Technology services is more hands-on with CRM software, compliance reporting, and roster management a few of their services.

What is particularly interesting about IQVIA’s current TAS segment is something called “Real World Evidence” which is growing at a mid teens rate and accounts for 25% of the segment. This evidence is used in what is considered the Phase IV of a clinical trial where a drug’s effectiveness in other use cases are tested. In a recent and high profile example, Eli Lilly developed Mounjaro for diabetes, but then found that it also was an effective treatment for weight loss and created Zepbound, adding multiples to their earnings. IQVIA’s data allows drug companies to find the patients that fit particular parameters to see if a drug would work in a different use case. This data is enormously valuable and serves as a call option for pharmaceutical companies to potentially boost their earnings significantly for a relatively low cost.

Quintiles, now the Research & Development Solutions (R&DS) segment, is the CRO part of IQVIA where they primarily focus on Phases II-IV of clinical trials. The current R&DS segment does business with just about everyone in the medical space whether they are a functional service provider (FSP), where they do part of the trial, or a full service provider.

This graphic includes the TAS segment, but you get the point

With so many clients, IQVIA usually conducts around 2,500 clinical trials each year. This results in a backlog of $31.1 billion (compared to $24.8 billion at the end of 2021), with 25% of that being converted to revenue within the next 12 months. 60% of this backlog is composed of contracts with large pharmaceutical companies and 20% is considered emerging biopharma.

IQVIA’s exposure to large pharmaceutical companies is also a partial risk for the company. FSP bookings have been trending from 15% of bookings towards 20%. A continuation in this trend past 20% would lead to some significant margin compression. Management believes this to be a cyclical issue similar to what they saw from 2014-16 because even large pharmaceutical companies do not have the same capabilities and data as IQVIA. Nevertheless, the biggest pharmaceutical companies have a lot of resources, so the ratio of FSP to total bookings could be something that is worth paying attention to.

Using data from the TAS segment, IQVIA is able to offer more efficient trials relative to Quintiles and even current competitors. After the merger, IQVIA saw a “50% reduction in site selection times, 30%-75% reduction in trial start up times and 60% increase of patient enrollment speed” for their clinical trials. The company then saw a “further 33% reduction in site selection times and 34% reduction in recruitment rates” by 2021.

Returns?

IQVIA lays out their growth algorithm as:

Their growth from R&D spend and outsourcing may actually be fairly conservative when compared to the average of the studies mentioned earlier. Also management held their previous investor day during a time where more money was being tossed around and projected higher growth rates. Now that the industry is more pessimistic, management has also adjusted their guidance. My general sense tells me that management was being too optimistic before and too pessimistic now, so the 9% CRO industry growth could be a fair proxy. Also at the recent investor day, management themselves said that their estimated 1% growth coming from market share gains is likely too conservative. Regardless, it is important to be overly conservative to provide an adequate margin of safety.

With some quick assumptions of 7% earnings growth with a rerating from 17x earnings to IQVIA’s historic average of 21x, forward returns would be around 10% without accounting for share buybacks. If this is the base case then it's hardly something to get out of bed for. However, when compared to management’s commentary and other metrics it seems out of place. If IQVIA grows earnings with the CRO industry projections or with management's guidance of HSD to LDD EPS growth, forward returns jump up to 14-15%. Returns jump even higher when looking at past performance. With an ROIC of 22% and a reinvestment rate of 90% IQVIA grew intrinsic value at 20% annually over the last five years, which is well above the forward returns predicted with those quick assumptions.

When buying a company I like to be overly conservative with my assumptions. We are not obligated to buy a particular company or any company at all for that matter. The current valuation just does not make this an obvious investment for me right now. This work did lead me to another company though…

Fortrea

Fortrea is a CRO that spun off from LabCorp in mid 2023. Almost in the exact same way that Mr. Pike divided Quintiles (more on this later), Fortrea is split into two segments: Clinical Services and Enabling Services. Clinical Services is the clinical pharmacology and CRO part of the company. Over the last 5 years, the company has conducted almost 6,000 clinical trials with over one million participants. They offer full service and functional service with a revenue mix that is 50% large pharma and 50% biotech.

The Enabling Services segment is the data arm of the company offering services for patient support and also clinical trial management and analytics. Fortrea has an agreement with Labcorp to gain access to their data to further increase the company’s offerings.

Fortrea sees a higher longer term growth rate for the CRO industry at 6-9% compared to IQVIA. The majority of this growth is projected to come from biotech companies which Fortrea has a larger exposure to relative to IQVIA which could explain the difference. Fortrea also has a large oncology presence and with 40% of drugs in the pipeline being oncology or anticancer drugs, Fortrea benefits even more.

Despite possessing the positive attributes of a CRO, Fortrea has not been run well under LabCorp with margins well below the industry average.

The CEO to Turn It Around

Tom Pike graduated from the University of Delaware, where he got a job in consulting, eventually working for McKinsey, who “taught [him] how to think.” He then switched careers from consulting to healthcare after a PE firm approached him to help start up a healthcare company that serviced hospitals. From there, he found the opportunity to become the CEO of Quintiles, where he thought it was a perfect balance between his consulting background and interest in healthcare. In order to actually get the job, he had a whopping 17 interviews, with one of them lasting 6 hours.

Prior to Mr. Pike joining Quintiles, the company had three things going for it: a deep expertise in statistical analysis, the largest global presence out of any CRO, and large early investments in technology. Mr. Pike’s job was then to sculpt and shape the company in a way that got the most out of these areas. A trend that he saw was the importance of CROs attempting to disrupt the traditional value chain. CROs used to do small parts of the drug development process, but Mr. Pike saw the value of being partners with the pharmaceutical companies and taking over more, if not all, of the drug development process, similar to what the current industry landscape is like. While running Quintiles, Mr. Pike was focused on the customer. From an interview with Boston University, he said, “In general, though, the way I try to run the company is. If it is good for the customer, it is good for us.” He distilled his philosophy down into “If we increase our customer’s probability of success, we will be successful.” Which, in the healthcare industry, is especially important. This philosophy seemed to work as well.

While Mr. Pike was the CEO of Quintiles from 2012 to 2016, he was able to increase the company's EBITDA margins by 425 basis points, from 11% to 15%. This resulted in Quintiles outperforming the market by around 50%. Quintiles also received several accolades, including being named the World’s Most Admired Company by Fortune in 2015.

The same culture that Mr. Pike, instilled with huge success, is coming along with him to Fortrea.

“One of the unique things that we get to do is we get to rebuild a culture,” said Pike. “As good as the Labcorp culture is, we’re going to pull the good stuff—the ethics, the integrity, the focus on science—from the Labcorp culture, and we are going to develop a world-class service culture to serve biopharma.”

Mr. Pike is also heavily financially incentivized for his tenure at Fortrea to be a success. In the company’s most recent proxy statement, they disclosed that Tom Pike was granted almost 500,000 RSUs and stock options to purchase 799,272 shares at $26.52. This gives him a significant incentive to improve the company’s operations and in turn boost the stock price. The compensation seems to also be a sizable portion of his net worth.

An Expense Problem?

Something that has caused a number of investors to run away from the company has been the increase in expenses across the company. EBITDA margins got as low as 4% at one point. What is happening?

There is more to the story than just uncontrollable rises in expenses. As Fortrea was spun out from LabCorp, they entered into a transition services agreement (TSA) with LabCorp. This agreement is for LabCorp to provide their IT systems and other services to Fortrea, at a cost, while they navigate life as a new company. Fortrea is in the process of moving their data and getting their own systems in place for when the TSA expires. As a result, their costs have temporarily ballooned. LabCorp, per their quarterly report, is charging Fortrea $23 million per quarter for administrative and IT systems support. Fortrea’s new systems will cost them just $15 million per year, resulting in around $77 million in cost savings. This is already well underway with “90% of the servers and application systems” already migrated to Fortrea’s system. Fortrea projects that all the TSAs with LabCorp will be exited by the end of 2024. This has already resulted in EBITDA and free cash flow increasing significantly. Fortrea projects between $74-94 million of EBITDA for Q4 2024 relative to just $27 million of EBITDA in Q1.

A Debt Problem?

In Q1 2024 Fortrea seemed to have a debt problem with the company being leveraged at over 7x EBITDA. Understandably, many investors took this at face value and fled the scene. But does Fortrea really have a debt problem?

Much like the “expense problem,” there is more than meets the eye. Fortrea has a very bad cash conversion cycle, not a debt problem. Looking at their balance sheet, they had almost $1.1 billion in accounts receivable/unbilled services in FY23. That is a lot of cash tied up for a company whose market cap is just $1.7b. Just two companies accounted for 27% of that whole accounts receivable number; therefore, when the contracts with these two companies get negotiated, a lot of cash can easily get unlocked. Fixing their working capital cycle is an easy way to unlock a lot of cash, and they are already doing it. From Q1 2024 to Q3 2024, the company cut their net days sales outstanding in half down to 50 days. Which resulted in the company having already reduced their accounts receivable number to $689 million. With this unlocked cash, Fortrea has been able to reduce the debt load to $1.1 billion from $1.5 billion the same quarter last year. With 2024 FCF looking to come in at around $275 million (temporarily inflated from the change in net working capital) and cash on hand of $100 million, the reports of a debt problem are greatly exaggerated.

Valuation

Between the CRO market downturn and the two problems I mentioned above, the valuation for Fortrea is very depressed. Fortrea is trading at just 13x last year's FCF; this is relative to competitors who trade at 20x FCF and above. It’s not like Fortrea is not growing either; their backlog grew 6% to $7.6 billion. Due to the nature of the CRO industry, even if Fortrea executes poorly over the next few years, the company should still grow at low single digits.

From a reduction in SG&A and interest expenses, there is a relatively easy path towards >$300 million in FCF within the next couple of years putting the company at just 6x FCF. If it takes 3 years for the company to get to $300 million in FCF and then another 5 years for it to rerate to 20x FCF, the forward returns would still be a 16% IRR over 8 years. To me, this is a far easier argument to make than for a company like IQVIA.