Pinduoduo was founded in 2015 and is the fastest company in history to reach a market cap of $100 billion. The founder, Colin Huang, studied Tencent and Alibaba and found that they operate in almost completely separate spheres. Tencent operated in a more social environment while Alibaba stuck to e-commerce. Colin thought he could split the gap of sorts and make his own company that incorporates elements of both spheres.

The immediate predecessor to Pinduoduo, Pinhaohuo was also founded in 2015, with a focus on bulk ordering fruits from rural farms. Pinhaohuo grew very quickly, becoming the most popular app later the same year. Unfortunately the impressive growth caused quite the scare for the company. Demand outpaced the company’s warehouse network by over 3x causing order fulfillment to drop 80% and customer retention to fall to just 25%. Luckily, Colin and his team were able to open more warehouses and automate much of the process in a short period of time. Pinhaohuo soon recovered and grew larger than Alibaba’s fruit business.

While that was all going on, Colin launched Pinduoduo. Pinduoduo and Pinhaohuo merged in 2016, but by 2017, the Pinhaohuo capital heavy model was shut down, leaving just Pinduoduo and its group buying model.

The Model

Pinduoduo benefits from two distinct models: C2M / group buying and interactive e-commerce or as Colin calls it “a combination of Costco and Disneyland."

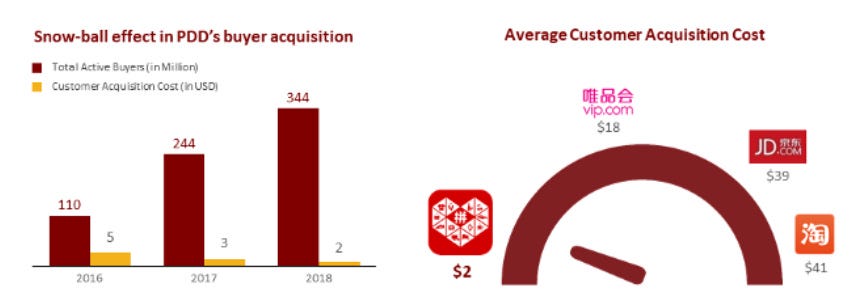

As the name implies, group buying is when a group of people come together to buy a particular item, usually from the manufacturer, to benefit from bulk pricing. Costco may go out and buy 100 items at a lower price than an individual, but enough individuals can be their own Costco. With group buying, the manufacturer of the item sets some kind of order requirement, say maybe 100 orders. Then the consumers need to group together and buy at least 100 orders to unlock the cheaper bulk price, just as Costco would do (this is called demand aggregation). If a consumer finds a deal they like, they typically send it to friends so that they can both get the deal themselves and help get the deal for others. Tencent’s partnership with Pinduoduo, in the form of a 15% stake, amplified this effect as Pinduoduo was able to benefit from Weixin users and deal links sent through Weixin. This social aspect also benefits Pinduoduo by taking advantage of the user's psychology. If your friend asks you to buy something for a few RMB to save them money, you look like a real dick if you don’t help them out, so you naturally join the platform as well. Furthermore, 评论尸, a Chinese analyst proposed the idea that social commerce fosters more purchases. If a friend you trust sends a link to an item that they found helpful, then it must be a good product worth buying. This has resulted in incredibly low customer acquisition costs.

For the consumer, the overall process looks something like this:

The group buying model also takes advantage of C2M or consumer to manufacturer. This is when the consumer orders directly from the manufacturer, thus cutting out any middlemen who might add costs. Even Costco marks up their prices 15% or so. Group buying is extremely beneficial to both the consumer and the merchant as the consumer gets bulk discounts (sometimes 90%) and the manufacturer can boost their bottom line (which will be touched on later).

The second major model that Pinduoduo uses is interactive e-commerce. Interactive e-commerce resembles traditional offline shopping, where there is fun in the act of shopping, rather than it being a choir.

There is more of a focus on being served items than actively searching for them, like with Taobao. Using Pinduoduo as an example, the search bar is pretty small, and the home page is dominated with large images of deals to entice the consumer. As you scroll down you get served with various deals that differ from day to day. It forces the consumer to check in every day on deals, but also makes the experience feel like a treasure hunt. To make the app even more appealing, Pinduoduo has numerous games as well.

Pinduoduo has gamified shopping to increase user engagement in hopes that the consumer will purchase more. It is especially popular with the lower class where 占小便宜 (the habit of spending excess time for a reward) is common. Two of their games are Duo Duo Orchard and Duo Duo Factory where the user logs in everyday to complete tasks and after they complete a certain number of these tasks they get free products from Pinduoduo. In addition, Pinduoduo has games similar to Candy Crush, which can be played to get deals as well. This causes users to open Pinduoduo at the bus stop to kill time with either the games or browsing the deals, which often results in snap purchases.

Pinduoduo’s strategy can basically be summed up with a quote from the company:

“I mean, we can’t imagine people wanting to overpay and view shopping as a chore.”

Merchants

In 2015 Taobao banned 200k merchants from their platform over quality control and counterfeit concerns. These merchants needed a new home and luckily Pinduoduo was just starting up. Merchants have continued to flock to Pinduoduo with the total merchant count growing 42x to 8.6 million between 2017 and 2020. While the company may have gotten a jumpstart from potentially counterfeit merchants, word spread that Pinduoduo treats their merchants well. The group ordering mechanic of Pinduoduo allows manufacturers to “sell certainty” to upstream patterns to lower their COGs. Also due to the C2M model, merchants on Pinduoduo can significantly increase their returns. Hayden Capital talked to a merchant who said that by switching to Pinduoduo they increased ROI by 2.4x and increased EBIT margins by 1000 basis points compared to other distribution channels, all resulting in a 12.5% boost to bottom line.

Furthermore, Pinduoduo offers superior marketing tools when compared to competitors. Pinduoduo knows not all their merchants are tech savvy people, thus they’ve made their tools as simple as possible. These tools have been proven to further boost ROI. Pinduoduo has become the preferred platform for many merchants and should cause them to stick around.

Supply Side Competition

In the physical world we have main streets; in every town or city there is always at least one street with the most foot traffic. The merchants on that street have to pay much much more to be there because of that foot traffic. In my particular town, the rent on main street can be 4x that of a store only one or two streets over. Now imagine you own the entire main street. With so many vibrant storefronts it's not a problem attracting people, so you don’t need to worry about that. Then you look at the merchants. People from all over the town want a storefront on main street and are willing to pay more than some of your current commodity type tenants. Naturally you replace your old tenants with these new rents because they provide the same product, but will pay you more. As time goes on this process can keep going and you can keep charging higher and higher rents.

This is exactly what platform companies like Pinduoduo do. While an online platform (in theory) allows the consumer to see a virtually unlimited number of products from an unlimited number of merchants, really only the top handful matter. If you're looking to buy a specific book on Amazon, you really only look at the first few results. I highly doubt you go to the second or third page of listings to check for other merchants who are selling the same book. Furthermore, often if a product can’t be found on Amazon, consumers feel like it doesn’t exist at all. Platforms know all of this, so much like a landlord increasing rent on main street, these platforms charge higher and higher advertising fees to merchants. This isn’t discretionary for the merchants either. It’s pay for advertising and marketing, or fall into the pits of despair on the 5th page of the search result.

“In other words, it’s the competition among the supply-side of the platform that drives take-rates, rather than the demand-side” - Hayden Capital

For the two large 3P marketplaces in China, Taobao and Pinduoduo, marketing accounts for 80% and 75% of their revenue, respectively. They each charge a roughly 4% take rate compared to 8-15% for Amazon or the hellish 30% for the App store, so naturally the Chinese firms generate less total revenue from these take rates, but suggests that they have room to raise rates if the competition subsides.

Pinduoduo has found a sweet spot where it's a win-win-win. Consumers get lower prices, merchants get higher margins, and Pinduoduo makes money from it all. It is extremely impressive to say the least.

Growth

Before getting into any numbers I think this quote from Huang is extremely important:

“Pinduoduo is dedicated to investing in the future and will always focus on the long term. It might appear too aggressive or too conservative at times. However, it always follows the basic and simple principle—growing its long term intrinsic value.”

- 2018 shareholder letter

Pinduoduo’s astronomical rise can be largely attributed to the models I mentioned above that drive lower prices and users to the platform. It is interesting to note what Colin has said about these lower prices though.

“Low prices are just the way we acquire users in stages. Pinduoduo has a deeper understanding of cost performance than most platforms—that is, it is always beyond the expectations of consumers. The core is not "cheap", but to satisfy the user's feeling of taking advantage.”

In addition, there are also a few other smaller points that have contributed to Pinduoduo’s rise. Pinduoduo benefits from a lower barrier of trust than most of its competitors. The products on their platform are typically on the cheaper end, thus if any manufacturer turns out to be a fraud, the consumer may only lose a few RMB instead of a few thousand RMB from a fraudulent computer manufacturer.

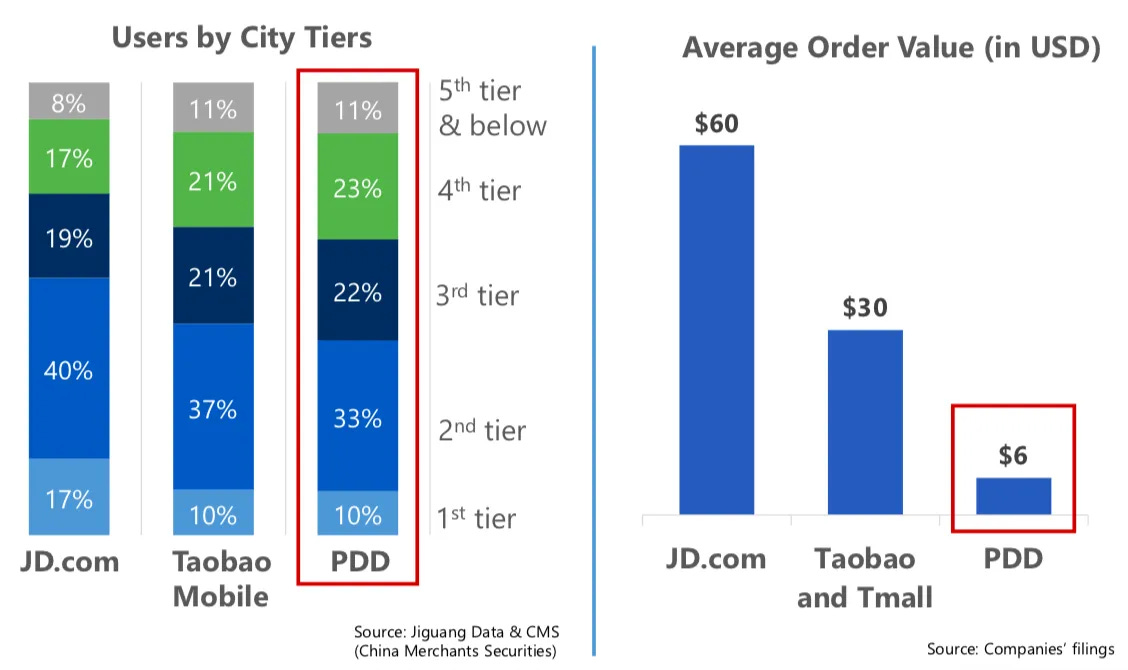

Furthemore, Taobao and JD effectively ignored rural China out of fears of lower margins. While it seems stupid now, this decision to ignore rural China was justifiable at the time. The entire region would need to be built up with infrastructure and even if Alibaba or JD were able to do that, rural China’s disposable income is less than half that of urban China, suggesting that the GMV would be much lower and not worth the effort. JD’s primary focus is on Tier 1 and 2 cities, like Shanghai and Xiamen, where the discretionary income is 3x that of rural China.

Pinduoduo’s focus on lower tier cities and income groups is starting to show even more benefits. Not only are consumers in tier 1 and 2 cities looking for ways to save money on everyday items, but also the developing middle class is starting to be made up of individuals who relied on Pinduoduo when they were in the lower class. The company is effectively piggybacking off of Xi Jinping’s policies of domestic circulation. Thus Pinduoduo may gain an advantage over incumbents in the middle class markets, but this remains to be seen.

Pinduoduo has also spent excess amounts of capital on discounts and deals for its consumers. The company has spent over RMB100 billion on sales & marketing since 2015 to bring users to the platform. There is much concern over this, but I now find much of it to be irrelevant.

“Pinduoduo has the ability to generate revenue, but it is weakly correlated with the large amount of spending we choose to incur. These short-term expenses are highly discretionary. In fact, we view a significant portion as long-term investments where we foresee meaningful continuous returns. It is probably not a good idea to put our money “in the piggy bank" into a fixed deposit at this stage. Hence, we will not change our business strategy for a considerable period of time. We will continue to focus on building our intrinsic value and proactively seek investment opportunities that can drive the long-term value of our company, even if these investments are recognized as expenses under the accounting standards.” - 2019 shareholder letter

Colin is saying that he sees these sales & marketing expenses as investments to grow the intrinsic value of the company and that if they were to stop spending on these discounts they would be able to generate significant levels of net income. He is most certainly right. If you were to cut Pinduoduo’s s&m spending by 50%, the company would have generated $7.2 billion in net income. Despite the crazy profitability Pinduoduo could generate if they choose to slow down their s&m spending, I find it unlikely that they will ever choose to do so.

Pinduoduo’s excessive spending on discounts and deals for their consumers is a derivation of the Scale Economies Shared model, but on steroids1. Costco, another company that follows the SES model, is able to use its scale to acquire products in bulk which then can be passed to the consumer, but they have to deal with all the overhead from taking ownership of products, so prices still have to be raised 15%. PDD’s overhead is just 2% of revenue, which gives them so much more margin to play with and ultimately what gives PDD the ability to then add another layer of discounts to the already discounted products. It is also interesting to note that Colin specifically mentioned Costco as a way to look at Pinduoduo. Much like Amazon and Costco, Pinduoduo is forgoing profits in the short term to strengthen their long term position. Well forgoing may be too strong of a word for Pinduoduo. The company still generated RMB31.5 billion of net income in 2022 after all.

The s&m spend is not just lighting cash on fire either as seen with the graphs below.

The graph shows the effectiveness of 1 RMB spent on marketing. For every 1 RMB spent on marketing in 2020, GMV on PDD increased by RMB40.48 and revenue increased by RMB 1.44.

PDD’s Monetization rate (revenue generated from GMV sold) is roughly inline with Alibaba’s:

“Since Pinduoduo's revenues primarily come from marketing fees, the monetization rate can also be interpreted as how much merchants are willing to pay for the platform's marketing services per each yuan of product sold.”

- Investor Insights Asia

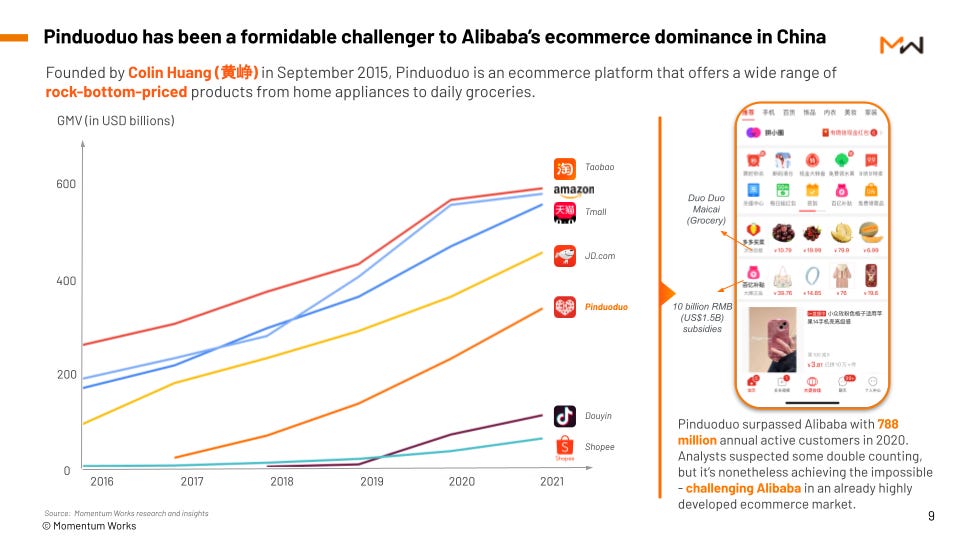

As for the growth numbers themselves, GMV grew at a CAGR of 85% and the number of orders placed grew 9x, from 4.3 billion to 38.3 billion, during the 2017 to 2020 period. GMV is now RMB2.4 trillion. There are concerns that PDD is double counting their GMV and while I’m not able to give an opinion with 100% conviction, it seems that it's largely an academic issue rather than a material issue. PDD is still spitting out cash flow regardless if the GMV is actually RMB1.2 trillion or RMB2.4 trillion.

Pinduoduo has roughly 750 million MAU, but it's important to note that MAU is calculated with only users on the mobile app. So for example, if you were to order something from Pinduoduo’s Weixin mini program, you would not be considered an active user (the active buyer metric is very inflated, so when looking at that, read the footnotes). Therefore, Pinduoduo most likely has a user base higher than what is actually reported. On one hand this is good as they have more scale, but on the other, there are no more users to acquire, thus no more growth.

While this may not be super relevant, I did find it interesting that Pinduoduo does not view growth and profitability to be mutually exclusive.

“When we talk about the growth strategy and the trade-off between growth and monetization, I think if you read through my share - letter to shareholders, in my mind, there is no trade off between growth and monetization. We really don't think it's a trade off.”

- Q3 2019 earnings call

In the future, Pinduoduo is hoping to be able to influence the entire production stream for products as well. Due to the huge amounts of data Pinduoduo has from its users, the company can coordinate with logistics companies to move trucks to areas where more demand will be imminent. Thus boosting revenue for the logistics company and speeding delivery for Pinduoduo. The data will also allow Pinduoduo to tell manufacturers what products that aren’t currently being offered are in demand. Currently Pinduoduo has taken a page from the Amazon Basic playbook and has used this data to sell their own products when no merchants are able to supply them. Management has said they don’t intend to grow this 1P business, but also that it's a strategic priority, which seems very Mao-esque. Perhaps they mean they want to grow the data portion rather than the 1P?

Pinduoduo also seems very open to trying out adjacent markets whether that be travel, real estate, or a return to its roots with food.

Duo Duo Grocery:

DuoDuo Grocery, launched in 2020, has already achieved dominant market share with estimates ranging between 40-50% of the total online grocery market in China. What makes this feat even more impressive is the competition they had to defeat to reach that point. In the first half of 2020, the online grocery market was dominated by the incumbent, XingSheng, and the soon to be market leader, Meituan. By the end of the year, Alibaba and JD had joined the party, among other smaller players. Despite all the capital flowing into the sector, Duo Duo Grocery prevailed and now sits in an oligopolistic position alongside Meituan.

Returning to Pinduoduo’s roots, Duo Duo Grocery is a next-day grocery delivery service that uses the same C2M model of Pinduoduo, but with an extra layer or two. Farmers first must deliver their products to a Pinduoduo warehouse to be shipped out the next day. From there Pinduoduo then partners with a logistics company to bring the goods to their destinations. While most e-commerce final destinations are to the consumer’s door, Duo Duo Grocery delivers the items to a “group leader” (usually a convenience store at the bottom of an apartment block or something similar). This leader then sorts the items for their respective consumers so they can be picked up on the way back from work. For their efforts, the group leader receives a 10% commission, and while this does slightly raise prices, they are still dramatically lower than traditional distribution models.

Interestingly management has hinted that they may not need group leaders or that they’re not needed for customer acquisition. In an interview with an undisclosed PDD executive, they said “with an active buyer base of more than 780 million, Pinduoduo does not depend on community leaders to attract users for its Duo Duo Grocery service.”

Keeping with the theme of slightly altering the Pinduoduo model, DuoDuo Grocery is much more capital intensive than Pinduoduo. The online grocery market has yet to gain the necessary infrastructure, thus Duo Duo Grocery “have taken the decision to invest in developing an agri-focused logistics infrastructure platform that will reduce waste, lower costs and speed up delivery for agricultural products.” The combination of stepping into a more capital intensive business along with delivery companies historically failing in the West has caused some concern, but they’re mostly overblown.

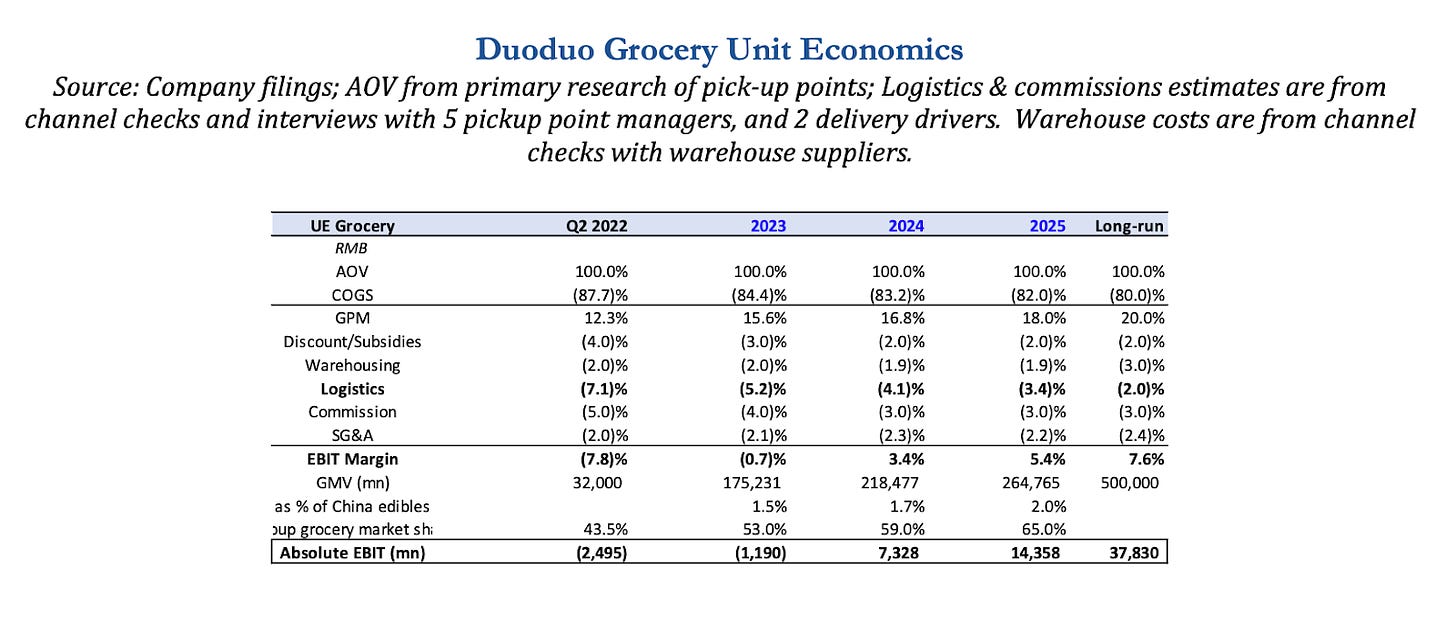

In the US we have an awesome amount of freedom, and as such, we mostly live in separate houses on separate parcels of land. China has commie blocks and apartment buildings where 5-12 thousand people live within 5 minutes of each other. The extreme population density is what makes the grocery delivery model profitable in China. While in the US you would have to take goods from the warehouse to each individual location, in China the “group leader” is effectively just another warehouse, thus making the business model closer to trucking logistics companies like J.B. Hunt in the US. As a quick check to confirm this, both JBHT’s EBIT margins and Hayden Capital’s long term EBIT margin estimates for Duo Duo Grocery are ~8%.

Duo Duo Grocery also only sells <2000 SKU’s, so that they can both simplify the logistics network and achieve greater bargaining power. Furthermore the company primarily goes after white label manufacturers and even oddly shaped produce to drive prices down even further. This has given them the low cost producer status in the Chinese online grocery market.

As with most industries, being a low cost producer is a great place to be. Because of this, I suspect that Duo Duo Grocery will continue to price their competitors out of the market allowing them to achieve even more economies of scale. With the sector growing at 16% yoy for the last several years and Duo Duo taking share, a reasonable approximation of future GMV growth may be around 20%.

EBIT growth will most likely be even more significant as Duo Duo Grocery continues to gain scale. Consumers will buy more products and consumers from new locations will increase route density. Hayden Capital has done some great work in figuring out EBIT margins that I can’t hope to compete with, so I will both summarize his work and link it below.

He suspects that fulfillment costs will roughly halve by 2024 due to the aforementioned efficiency gains. That combined with some other marginal improvements should result in a long term EBIT margin of 8.4% in his eyes. While I do agree with the vast majority of his estimates, I do not suspect that Duo Duo Grocery will cool off their discounts anytime soon; therefore, I’d conservatively adjust the EBIT margin estimation down to 3.4% by 2025. Furthermore, I believe the long term EBIT margin for Duo Duo Grocery is more likely to be ~5%.

The most recent agriculture GMV I could find was from Q4 2019 where 13% or RMB136 billion of total GMV was solely from agricultural products (Latepost estimates 2022 GMV at RMB180) billion. If we assume GMV didn’t grow from 2019 to 2022 and that GMV will grow at 20%. The resulting EBIT for 2025 would be RMB8 billion or $1.12 billion. Assuming 15x EBIT, in 2025 Duo Duo grocery would add $16.8 billion to PDD’s market cap.

Duo Duo Grocery is continuing to kill it and potentially making my numbers look silly. According to Latepost, half the regions Duo Duo Grocery operate in are already profitable while even the best regions for Meituan have yet to reach profitability. It seems Duo Duo Grocery has caught Meituan on the back foot as Meituan “have begun major management adjustments.” Furthermore, Duo Duo Grocery is rapidly taking market share away.

“Duoduomaicai’s market share in Chongqing was only 70% - 80% of that of Meituan Best. After the end of the first quarter, its market share has surpassed that of Meituan Best.”

Meituan is no longer publishing market share for these specific regions either. Overall it seems that Duo Duo Grocery is really cementing themselves as the new leader.

But wait there’s more! Pinduoduo is not just trying to make money with Duo Duo grocery, but also act as a launching ground for agritech efforts, which may become another important area for Pinduoduo.

Agritech

With 7% of the world’s arable land feeding 20% of the world’s population, China has begun increasing its focus on agriculture. As Lillian Li points out, “in the 14th Five Year Plan, grain production capacity has been highlighted as a binding indicator” for economic growth and Xi Jinping specifically addressed agricultural revitalization in the “Two Sessions” meeting. Rightfully so, despite recent gains in crop output, demographic and climate issues may substantially affect agricultural output and put the nation at risk of food insecurity in several years.

To take advantage of the economic opportunities in the Eastern cities, hundreds of millions have migrated from their rural towns, leaving in their wake an age crisis. The 2020 China Aging Development Bulletin showed that 23.8% of the rural population is over the age of 60. To make things even worse, not just for the agriculture sector, but for all of China, water is becoming an increasingly important issue for the country. The Ministry of Water Resources predicts that a serious water crisis could occur by 2030. Above the Yangtze River, China receives barely enough rain water to sustain agriculture and only holds 20% of the country’s water supply.

Despite this, 64% of total arable land and 40% of total farmland is located in Northern China. Even worse, China’s main energy source Coal, requires a huge amount of water. Beijing is a bit of a microcosm for Northern China as a whole. The capital city is below half of acute water scarcity placing it in the company of countries like Oman. Adding to the clown car of issues, roughly 50% of water in Beijing is classified for irrigation use or just completely useless. To compensate for this the CCP has tried moving water from the South to the North, but this hasn’t helped and may be making things worse. Moving all this water around has created almost a pyramid scheme of water transportation where the North feeds from the South causing the South to feed from elsewhere and so on. So yeah, there is a bit of an issue.

With all this context, you can see why agritech and Pinduoduo’s efforts are so important. Even just creating infrastructure to reduce crop waste with Duo Duo Grocery is a meaningful effort to combat these issues. Duo Duo Grocery is even allowing many younger folks to return to rural China because they now have access to millions more consumers. Furthermore, Pinduoduo has been experimenting with AI and various software components with agriculture. After running some tests against traditional farms, Pinduoduo found that their AI tools boost crop yields and increase ROI by 76%. Pinduoduo has also spent billions of dollars funding competitions and other projects to get more people to create solutions for problems in agriculture. With financial backing from Pinduoduo and other tech giants, more and more start ups have been able to find solutions to boost crop yields, but it remains to be seen if this strategy will prove to be effective in the long term. Unfortunately, Pinduoduo’s agritech is impossible to value at this point, so I’ll leave it at that for now.

Temu

Temu is Pinduoduo’s attempt to enter the North American market and now 14 other countries in Europe and Oceania. It was launched in September of 2022 and already has >50 million downloads with $400 million in sales for the month of April alone. Temu has even surpassed Shein in sales for the month of May. Originally, I had assumed that Temu would need to revamp its marketing strategy; however, I seem to be eating my words at this point given the rapid rise of Temu.

Betting on Temu is effectively a bet on the company culture as PDD has yet to disclose any financial information (the following can also be applied to Pinduoduo as well). Temu’s culture seems to be modeled off of Tencent’s with internal competition, flat corporate structure, and ruthless incentives being the core tenants. Multiple teams will be given the same project and even one failure of project will result in a demotion for the team manager. In addition, teams are monitored for their customer conversion rate and those that don’t reach the hurdle rate are broken up. What’s even more crazy is the Pinduoduo 721 model. 20% of employees won’t receive a full bonus and the bottom 10% will be eliminated from the company. It has undoubtedly allowed the company to rapidly expand, but at a cost. A Pinduoduo employee died back in 2020 due to exhaustion, which sparked outcries from many over the 996 work system and Pinduoduo specifically.

Both Pinduoduo and Temu use a very interesting hiring model. Instead of hiring the most qualified candidate, Pinduoduo has found that young poor employees perform better than well educated employees from tier 1 and 2 cities. The employees are compensated well with average salaries being 2-3x higher than the industry average. Pinduoduo has also copied Duan Yongping’s (I will talk about him later) “culture of autonomy” that, as the name implies, prioritizes local level autonomy. The entire company is composed of just three levels: corporate managers, category managers, and the grunts basically. It has worked wonders in terms of GMV / employee.

As a potential shareholder of the company, I find this structure and culture to be superb. Even at an increasingly large scale, Temu is still able to outmaneuver other more established e-commerce companies like Shein and partially Amazon as well.

Despite being a platform, Temu does have a good amount of control over its merchants. Contracts with merchants do not have exit clauses and effectively all liabilities are pushed to the merchant. Temu has also adopted the mantra of:

“If the sales performance is bad, it’s because the price is not low enough”

This has caused some concern for merchants as they’re effectively being told to reduce prices regardless of the impacts on their own margins. However, Temu has listened to merchants and eased on many of their programs. I’m getting the impression that Temu is seeing how low merchants can get their prices and then easing up a bit. It makes sure consumers get the lowest price, but as a merchant, I would be a bit concerned with this strategy.

As for the app itself, it’s quite different from what I’m used to with Amazon or some of the other US e-commerce companies. The search bar is much smaller and the home screen is crowded with incredible deals. You have the aforementioned C2M model + discounts, but the discounts are supersized so they can penetrate the US market. For $33 (maybe for free depending upon how this coupon system works) I got: a $50 backpack, a $12 car trunk storage thing, $6 worth of microfiber cloth, and 4 desk organizers worth $32. All with free shipping as well.

This does come at a steep cost for the company and I wonder if it's realistic for them to keep doing this. A company insider confirmed that Pinduoduo is losing $30 per order on Temu. The supply chains are much longer as they have to ship items across the Pacific, which calls into question can the model even work?

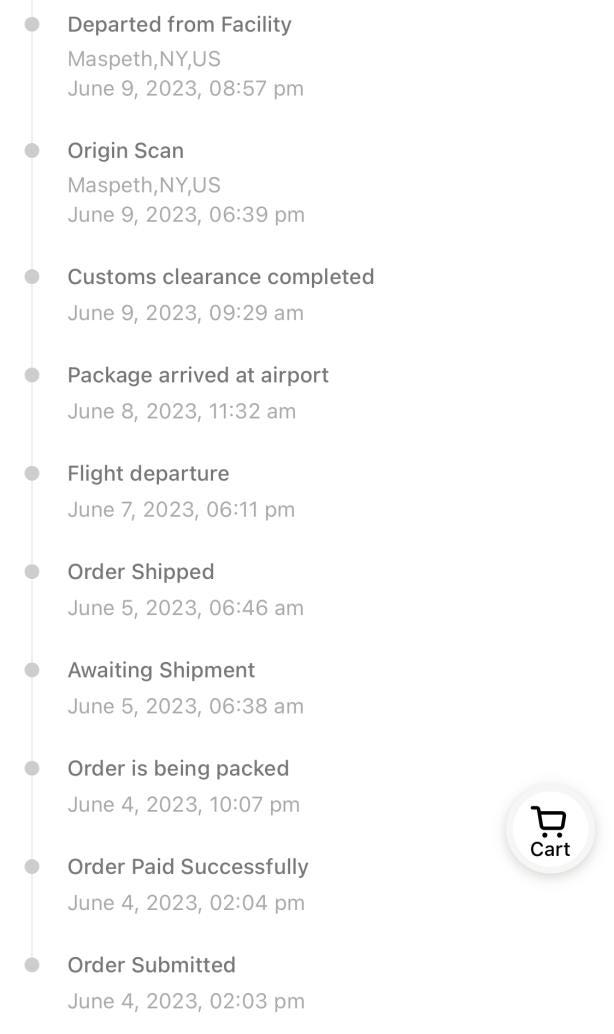

Temu’s current shipping system is impressive if not seemingly impossible. The items I ordered from four different manufacturers in China got to my doorstep roughly 13,000km away in 8 days. From tracking my package, it seems as if items are sent to an airport and then the plane waits until it’s completely full before heading out (suggested by the 2 days between the order being shipped and the flight departing). Once the plane landed in New York, my items were then sent to a distribution facility in New Jersey and then to another location before arriving at my door. I’m assuming that Temu’s logistics operators use a LTL model (less-than-truckload) or something that separates packages at each fulfillment center. It’s not super important how Temu exactly does it, but I did want to get a general sense of it all.

As for marketing, a few days ago, I told my friends about Temu and they only knew it because of the really bad ads that all say “this is 100% legit.” Saying your service is “100% legit” is probably the fastest way to get people to think otherwise, so hopefully they change that ad campaign a bit. Furthermore, they have to overcome the cheap China stigma and other issues that come from being a Chinese company in the US. My fear is that they end up becoming a Wish.com of sorts. Temu is really trying though. They run 4x as many ads on Facebook compared to Amazon and are like 50% of the ads I see on Youtube.

Unfortunately PDD hasn't directly disclosed any information related to Temu, besides that it exists, so valuing Temu is rather difficult. However, there may be some hope. According to independent sources, Temu’s Q1 2023 after discount GMV is close to $1 billion. GMV growth is on track to hit $3 billion for the half year and potentially $10 billion for FY 2023. Unfortunately, Pinduoduo has come out and said that the data is not true, so I will be disregarding any assumptions.

Therefore, from a valuation perspective, my concern is that it can’t be valued and it may be worth less than $0, so the price I am willing to pay for PDD is slightly lower than the intrinsic value of the core Chinese businesses. However, with Pinduoduo printing cash to fund Temu’s expansion and a killer culture, I am more optimistic than I thought I would be. In addition Hayden Capital mentioned rumors that Colin Huang is still making decisions at Temu and Singapore based Momentum Works seemed to heavily imply he still leads Temu even after stepping away from Pinduoduo and the company as a whole. This will definitely be a fun one to follow.

Management

Colin Huang is absolutely brilliant. His shareholder letters are riddled with great analogies, he articulates concepts clearly, and is just academically gifted. He studied computer science at Zhejiang University and then received his masters from the University of Wisconsin-Madison. Although he attended such prestigious universities, most of his learning probably came from his friends and experiences.

Colin grew up “tight on money” which has defined his spending habits to this day. He got into Zhejiang University where he learned about the story “The Race of the Field Marshal” (田忌赛马) which effectively defined comparative advantage. Colin realized that even when up against a superior enemy he could still outwit them, which may be why he decided to compete with both Alibaba and to a lesser extend, JD. What I personally find to be the most interesting is that Colin now regrets focusing solely on grades while in school. He now finds “long live 60 points [to be] a good philosophy." The philosophy is that passing is good enough and to find the“pure enjoyment of youth” is the best way to go.

“It wasn't until much later, after I'd been in business for a few years, that I began to realize that goal achievement and happiness aren't necessarily the same thing. I was very late in my thinking, understanding and exploration of happiness.”

While in college, Colin befriended William Deng, the founder of NetEase, who then introduced him to the top Chinese tech CEOs, and most importantly Duan Yongping. Duan Yongping was extremely impressed with Colin and has served as his mentor throughout his career. In 2006, Duan Yongping invited Colin to join him for lunch with Warren Buffett. Colin then returned to China to begin his entrepreneurial journey. He founded Ouku.com, a competitor to the early JD, in 2007 and sold it in 2010. In the same year he founded Xunmeng, a game studio, which he stepped away from a few years later due to a sickness. Lastly he founded Pinduoduo, but unfortunately he stepped down as CEO to pursue his own interests; after he successful completed the speed running billionaire challenge. While this pattern does seem odd, it aligns with the pattern of his mentor. Duan Yongping was making millions in the early 1990s at Subor then resigned and after building BBK electronics into a multibillion dollar company, he left the company at 40 years old. Both businessmen don’t find money to be particularly important, which is pretty funny when both are billionaires. Instead they seem to be more interest driven, and especially with Colin, driven by a desire of the common good. In his last shareholder letter, Colin outlines what he wants to do after leaving Pinduoduo.

“I want to work on research in the fields of food sciences and life sciences…Taking one step further, if we further research into the protein structures and their traits in the human body, could we build on the work of the 2016 Nobel Prize in Chemistry Laureates on molecular machines to produce protein-based molecular motor that can travel through the blood vessels in the brain and unclog them to prevent strokes?”

His desire to still change the world after already starting a multibillion dollar corporation is pretty incredible to me. I hope he does well and I can only applaud his decision.

While at Pinduoduo, Colin made a very interesting point. He believes that a company’s moat is dependent upon “assets” which deepen the moat and “costs” which negatively impact the moat. The following is from an interview of his that is translated into English, so it’s not perfect, but it gets the point across.

“In the purchase of assets, the wrong waste is actually not very good, at most it is just a little more expensive. The waste of expenses is very abominable, and often has negative effects. In the process of starting a business, there is a special type of asset that is united in a certain culture, and there is also a type of expense that is used to purchase labor or skills. cost.

The distinction and transformation of the two is very interesting, and it is also a matter with a particularly high return on investment. If the expenses are turned into value-added assets, then our CFO and investors are probably too laughing to fall asleep. But what is interesting is that many times when investing, the judgment of such a major difference is often hasty and the weight is far from enough.”

Very rarely have I seen a company founder present such an idea. I’m assuming he is referring specifically to s&m spend here based on that idea of an expense actually deepening the moat. It seems to add credence to Pinduoduo following an SES model that was mentioned before.

As for the current management team, both Co-CEOs have been with Colin since Pinhaohuo. Chen Lei, the Co-CEO who will be focused on the core Chinese market, is incredibly smart. At the age of 17 he won gold at the International Olympiad in Informatics and he attended Tsinghua University. Ziazhen Zhao, code name “Winter Jujube”, is credited with pushing for the C2M model at Pinduoduo, after seeing inefficiencies at an orange orchard in his hometown. Considering both Lei and Zhao have been with Colin since the beginning, I don’t suspect the culture will change much if it all. In an interview, Colin told the story of Buffett and Gates asking MBA students which of their fellow students would he invest in, suggesting that Colin too values a trustworthy partner over raw talent.

Management doesn’t disclose anything they don’t have to and has said various contradictory statements. It's almost a waste of time to read the earnings call transcripts and the Pinduoduo management team makes politicians look like toddlers when it comes to answering a question without actually answering it. They even hide away parts of the company completely. No numbers have ever been given about Temu. While it has only been about two quarters, it's funny to see that management really only acknowledges that it exists and nothing more. Duo Duo Grocery is stuffed in “transactional services” as mentioned before and they’re just generally secretive. I don’t see this to be an issue outside of making it more annoying to value the company. Some people have suggested fraud, but tricking Tencent, EY, and faking all that cash flow would be close to impossible.

Valuation

Valuation work here won’t be on what price I suspect PDD Holdings to be at after a given amount of time, but more if the current price seems reasonable or not. My valuation would most likely be incredibly far off if I even tried, but assuming I understood the business, its culture, and the growth avenues correctly, the company will eventually become enormous.

PDD’s LTM free cash flow excluding SBC and operating lease expenses is ~$6.5 billion. At the time of writing, PDD’s EV is $80 billion with a valuation of 12x FCF or 13x LTM EBIT. I had assumed Duo Duo Grocery would be worth $16.8 billion in 2025, so with a 20% discount rate, Duo Duo Grocery is currently worth ~$10 billion.

Online marketing services or the core Pinduoduo platform generated $15 billion in revenue for 2022 with my estimate for cost of revenue being just $436 million. Operating expenses for 2022 amounted to $9.9 billion for the company. Assuming all expenses were for the core platform, then this segment generated $4.6 billion of EBIT for 2022. With the current EV minus Duo Duo Grocery equating to $70 billion, the core platform business is trading at 15x EBIT.

While this is a bit higher than I am typically willing to pay for companies, it seems to be an extremely cheap valuation for a company growing at such a high rate. 20% revenue growth seems reasonable and is inline with both Hayden Capital and analysis from CMB international. Assuming the margins and multiple stay the same (which they won’t), then that is a 20% return.

PDD reported earnings for the first quarter of 2023 which I did not use in this write up mainly because they were mind boggling. Revenue grew 58% and net income grew 212% both relative to the same quarter last year. Transactional service revenue (Duo Duo Grocery) grew 86% and the core e-commerce platform grew 50%. My mind just isn’t able to understand those numbers, but hopefully that shows why I don’t think a multiple of 15x EBIT is reasonable for PDD Holdings.

Risks:

Overinvestment in ventures like agritech or Temu

PDD may lose sight of profitability and spend billions on subsidizing a potentially unprofitable agritech business or constantly fight an uphill battle to enter the US market with Temu. I suspect management will continuously measure ROIs and be able to pull the plug if needed, but ideological fever can run rampant.

Competition

Pinduoduo should be able to ward off legacy competition just fine, but they are facing competition with billions of dollars on their balance sheets and hundreds of millions of users, so it would be foolish to not acknowledge that there is competition out there. Yet the competition may be overstated, as Pinduoduo is “competing for the same group of users but under different use cases” compared to the likes of Alibaba and JD.

I will briefly expand on this point to try and provide a bit more context. Pinduoduo is one of the three major Chinese e-commerce companies (the other two being Alibaba and JD). JD takes ownership of the products then sells them to the consumer. This in addition to their primary market being 3C electronics, should make it so PDD won’t really compete with JD. The two companies are serving the bottom and the top ends of the Chinese market. PDD and JD are like two hydraulic presses squeezing Alibaba out of its market share.

I can’t help but notice some similarities between Alibaba and the Roman Empire. While the analogy may seem kind of strange, let me explain. Both were founded and led by incredible leaders, Jack Ma and Octavian. Both enjoyed a long period of success, the 2010s and Pax Romana. Both became too big for their own good, paralyzing the empire and succumbing to invaders. I am not going to say Daniel Zhang is Maximinus Thrax or Commodus, but the Alibaba Empire is not in good shape. The commerce barbarians of Pinduoduo, JD, Meituan, and Shopee have each specialized and aggressively beaten back Alibaba. Alibaba’s central government seems to be paralyzed or even shell-shocked because of it. They’ve announced restructuring and 3 year plans, but it seems too little too late.

“A senior employee of Alibaba revealed to the media that since Zhang Yong took over from Ma Yun, the internal factions of different organizations in Ali have been complicated. , these factions are increasingly intricate.”

Furthermore, while the following is a quote about the CGB segment of Alibaba, I think its fitting for the whole company

“Some people have concluded that the problem with Ali’s community group buying is that “the upper levels struggle, the middle levels stand in line, and the lower levels have no decision-making power.” Taocaicai’s 2021 goal is 120 billion GMV, and only 20 billion will be completed by the end of the year.”

From the company perspective, I fail to see how splitting Alibaba into pieces will help in any way. Its placing a bandaid over the cuts of complacency and bureaucracy. Alibaba has lost its founder era culture and will begin to get eaten alive.

Duoyin e-commerce is quite scary. This is the one I am the most concerned about and will be watching it periodically. My fear is that there will be a race to the bottom between the two as Duoyin begins adopting more of Pinduoduo’s strategies. I am hopeful as Pinduoduo is in a much better financial situation than ByteDance, so a race to the bottom should be in Pinduoduo’s favor.

Tail risk

The CCP or the US does something stupid that messes with either Pinduoduo or US investors.

Random

While none of PDD’s annual reports mention “Duo Duo Video”, apparently it exists and the DAU count is 100-120 million with daily usages of around 30 minutes. Pinduoduo has been enticing users with gifts just as they are with their games. It doesn’t seem to be monetizing very well nor bringing much GMV to the platform though.

Special mention to Sharp Investing who came up with the idea that Pinduoduo is using discounts as their form of scaled economics shared.

As this write up is a bit on the longer side, I figured I’d link some sources that I found to be particularly useful.

Compilation of Interviews with Colin

Also company filings and earnings calls as usual.

If I find any additional information while wondering around the internet I will either link it below this or edit the post.